Choosing the Right Commercial Real Estate Loan: A Complete Guide

Commercial real estate loans play a critical role in acquiring, developing, and maintaining properties for business purposes. For entrepreneurs, investors, and developers, understanding the various types of loans available and their uses is essential for making informed financial decisions. Whether you’re expanding a portfolio or securing your first commercial property, knowing the intricacies of each loan type will help you choose the best financing option. This article will explore the different types of commercial real estate loans and explain how they are used, providing a comprehensive guide to navigating the commercial lending landscape.

Table of Contents

1. What is a Commercial Real Estate Loan?

A commercial real estate loan is a mortgage used to finance the purchase, development, or renovation of commercial properties such as office buildings, retail centers, warehouses, and apartment complexes. Unlike residential mortgages, which are secured by the borrower’s primary residence, commercial loans are typically secured by the property being purchased or developed. These loans generally have stricter requirements, higher down payments, and shorter repayment terms.

Commercial real estate loans are typically used by businesses, developers, and investors looking to:

- Purchase a property for business use

- Expand an existing facility

- Refinance existing commercial properties

- Develop land for commercial purposes

- Acquire investment properties

2. Key Differences Between Residential and Commercial Real Estate Loans

Before diving into the various types of commercial loans, it is important to understand how they differ from residential real estate loans.

a. Loan Terms

Commercial loans often have shorter terms, ranging from 5 to 30 years, whereas residential loans typically have terms of 15 or 30 years.

b. Interest Rates

Interest rates on commercial real estate loans are generally higher than residential loans, reflecting the greater risk associated with commercial properties.

c. Down Payments

Down payments for commercial properties are usually higher, ranging from 15% to 35%, while residential loans can require as little as 3% to 20% down.

d. Loan-to-Value Ratio (LTV)

Commercial real estate loans often have a lower LTV ratio (65% to 80%) compared to residential mortgages, meaning the borrower needs to invest more equity.

e. Underwriting Process

The underwriting process for commercial loans is more complex. Lenders evaluate both the business’s financial strength and the property’s potential for generating income.

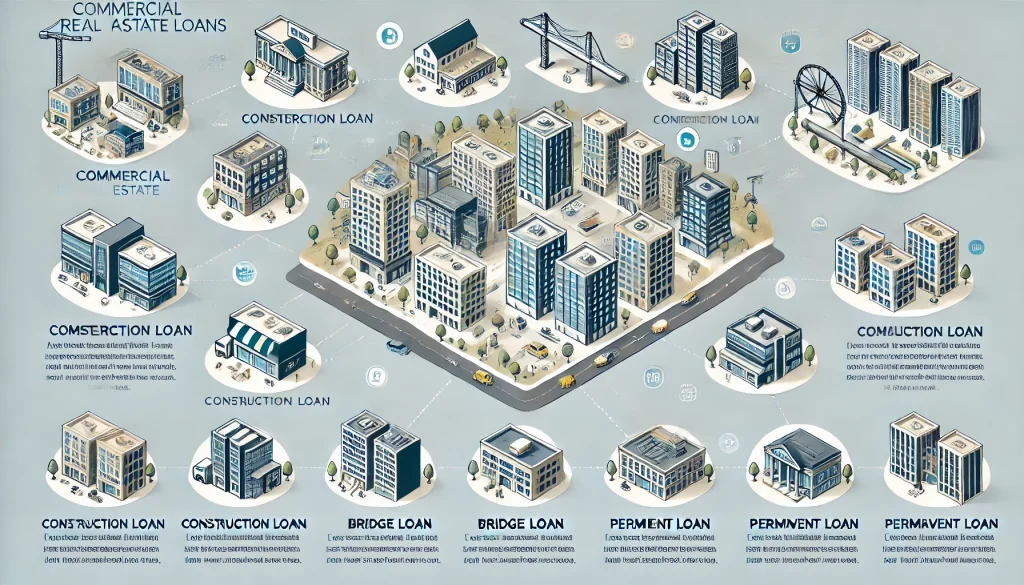

3. Types of Commercial Real Estate Loans

There are several different types of commercial real estate loans, each designed to serve specific purposes. Here are the most common types and their typical uses:

a. Permanent Loans

Use: Permanent loans are traditional, long-term mortgages used to purchase or refinance commercial properties that are already generating income. They typically have fixed or variable interest rates and terms ranging from 5 to 30 years. These loans are ideal for businesses looking to own a property for an extended period without plans for significant renovations or redevelopment.

- Who It’s For: Business owners and investors looking for long-term financing on stabilized properties like office buildings or retail centers.

b. SBA 504 Loans

Use: The SBA 504 loan program, offered by the U.S. Small Business Administration, is designed to help small businesses acquire fixed assets like commercial real estate or equipment. It provides up to 90% financing, making it an attractive option for businesses with limited capital. The loan consists of two parts: a conventional lender providing 50% of the loan, and a Certified Development Company (CDC) providing 40%, while the borrower covers the remaining 10%.

- Who It’s For: Small business owners seeking to purchase property for their business operations with minimal down payment requirements.

c. SBA 7(a) Loans

Use: Another option under the Small Business Administration, SBA 7(a) loans can be used for a variety of purposes, including purchasing commercial real estate, renovations, or working capital. These loans provide flexibility in terms of property type and loan usage, but they generally come with lower loan limits than SBA 504 loans.

- Who It’s For: Small business owners needing flexible financing for both real estate and operational purposes.

d. Bridge Loans

Use: Bridge loans are short-term loans used to bridge the gap between the purchase of one property and the sale or refinancing of another. These loans are typically used by developers or investors who need immediate financing while waiting for a more permanent solution. Bridge loans usually have higher interest rates and shorter terms (six months to three years), but they offer quick access to funds.

- Who It’s For: Investors or developers needing temporary financing while securing long-term funding or selling an existing property.

e. Construction Loans

Use: Construction loans provide funding for the construction or renovation of commercial properties. These loans are short-term and typically convert into a permanent loan once the construction is completed. Borrowers receive the funds in stages as the project progresses. Construction loans usually require a detailed plan for the project, including cost estimates and timelines.

- Who It’s For: Developers or business owners planning to build a new commercial property or make significant renovations.

f. Mezzanine Loans

Use: Mezzanine financing is a hybrid of debt and equity financing, allowing the lender to convert the loan into equity in the event of default. These loans are typically used by businesses or developers who need additional capital after securing a traditional loan. Mezzanine loans come with higher interest rates and are often used in large development projects.

- Who It’s For: Investors and developers seeking additional financing for large-scale commercial projects.

g. Hard Money Loans

Use: Hard money loans are short-term, asset-based loans provided by private lenders. These loans are typically used when a borrower cannot qualify for a traditional loan or needs quick access to funds. Hard money loans come with higher interest rates and shorter terms, and they are secured by the property itself.

- Who It’s For: Investors needing quick financing for property acquisition, especially in distressed or high-risk situations.

4. How to Choose the Right Commercial Real Estate Loan

Selecting the right type of commercial loan depends on your business’s financial situation, the type of property you are acquiring, and the intended use of the loan. Here are a few factors to consider when choosing the best loan for your needs:

a. Purpose of the Loan

- Purchasing an existing property: Permanent loans or SBA 504 loans are ideal for businesses looking for long-term ownership.

- Construction or renovation: Construction loans are the best fit if you’re building or heavily renovating a commercial property.

- Temporary financing: Bridge loans or hard money loans can provide quick access to capital for short-term needs.

b. Financial Strength of Your Business

- Cash flow: Lenders will examine your business’s ability to generate consistent income. Strong cash flow can make it easier to qualify for lower interest rates.

- Credit score: A high credit score increases your chances of securing a loan with favorable terms.

- Assets: Commercial loans often require significant collateral, so having valuable assets can improve your loan options.

c. Loan Terms

- Consider the length of the loan term and the repayment schedule. Shorter-term loans may have higher monthly payments but lower overall interest costs, while longer-term loans may offer lower monthly payments but higher total interest.

5. Advantages and Disadvantages of Different Loan Types

Permanent Loans

- Advantages: Long-term stability, lower interest rates, and predictable payments.

- Disadvantages: Requires a higher down payment, limited flexibility.

SBA 504 Loans

- Advantages: Low down payments, competitive interest rates, and government backing.

- Disadvantages: Lengthy approval process, restrictions on loan usage.

Bridge Loans

- Advantages: Quick access to funds, flexible terms.

- Disadvantages: Higher interest rates, short repayment period.

Construction Loans

- Advantages: Funds released as needed, flexible terms based on project progress.

- Disadvantages: Higher risk, requires detailed planning, shorter terms.

Mezzanine Loans

- Advantages: Provides additional capital, can be used in conjunction with other financing.

- Disadvantages: Higher interest rates, risk of losing equity.

Hard Money Loans

- Advantages: Quick approval, flexible terms.

- Disadvantages: High interest rates, short terms, high risk for the borrower.

6. Tips for Securing a Commercial Real Estate Loan

a. Prepare a Strong Business Plan

A well-prepared business plan demonstrating the property’s potential profitability is key to securing a loan. Include market analysis, financial projections, and a clear loan repayment strategy.

b. Build a Strong Credit Profile

Maintaining a good credit score and a strong financial track record can improve your chances of securing a loan with favorable terms.

c. Consider Government-Backed Loans

Government-backed loans like SBA 504 or 7(a) loans are easier to qualify for and often come with better interest rates and terms.

d. Work with a Real Estate Broker

A knowledgeable real estate broker can help you navigate the complexities of commercial real estate loans and find the best financing options for your needs.

7. Conclusion

Understanding the different types of commercial real estate loans and their uses is essential for businesses, developers,