New Auto Replacement Insurance 2024

Auto Insurance Replacement

New replacement auto insurance can be the answer if you want more assurance after driving a new automobile off the lot. This kind of policy will assist you in recovering the entire worth of your new car in the event that it is written off soon after purchase, as opposed to the depreciated value that an insurance company would generally provide. You’ll be able to enjoy your auto insurance with less worry if you purchase this additional coverage.

Overview of New Car Replacement Insurance

Usually, insurance companies will demand you to have both collision and comprehensive coverage in order to get new automobile replacement insurance. Many states merely call for liability insurance, which covers other motorists, passengers, and other vehicles in collisions you cause.

No matter who is at fault, collision insurance protects your car, while comprehensive insurance shields it against environmental hazards like fallen tree limbs and flooding as well as theft and vandalism.

Cost of replacement insurance for a new vehicle

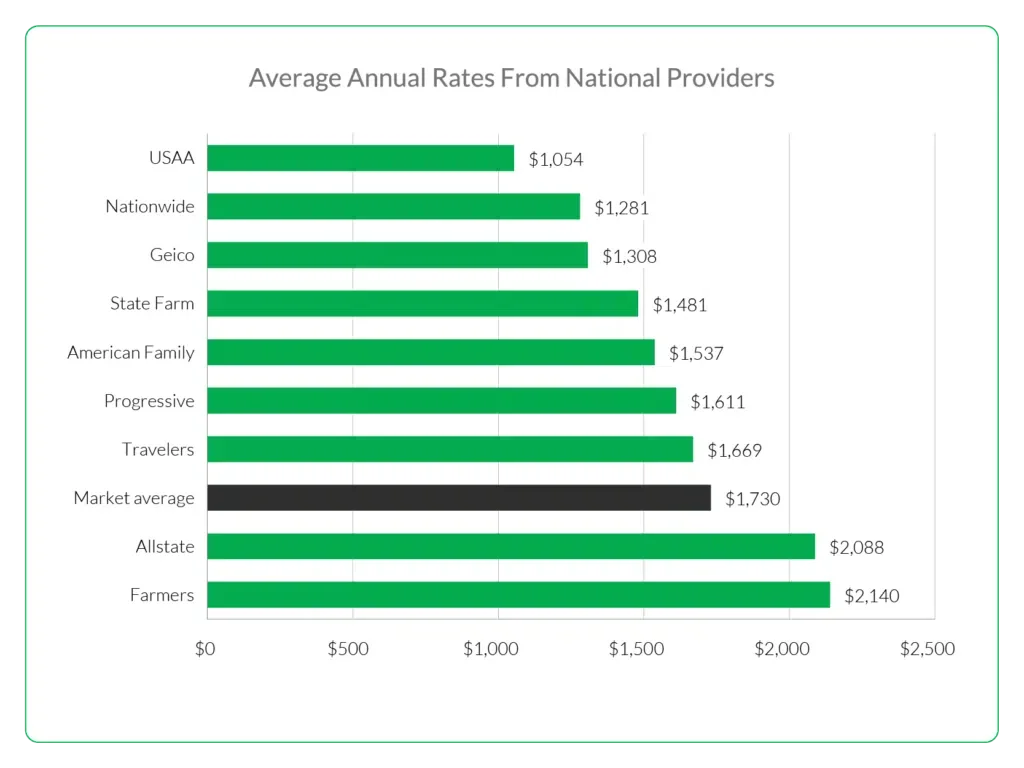

Understanding the normal cost of a full coverage policy is a good idea before estimating the price of a new car replacement insurance policy. A full year of full coverage auto insurance costs $1,730, or $144 a month, on average, across the country. Comparing insurance prices offered by several companies is, as usually, the most effective technique to find an exact cost.

The chart below shows the average annual rates for a number of the biggest nationwide providers so you can get an idea of what you would pay. These premiums apply to 35-year-old drivers with excellent credit and spotless driving records who want full coverage policies. Your charges will change depending on a variety of unique characteristics.